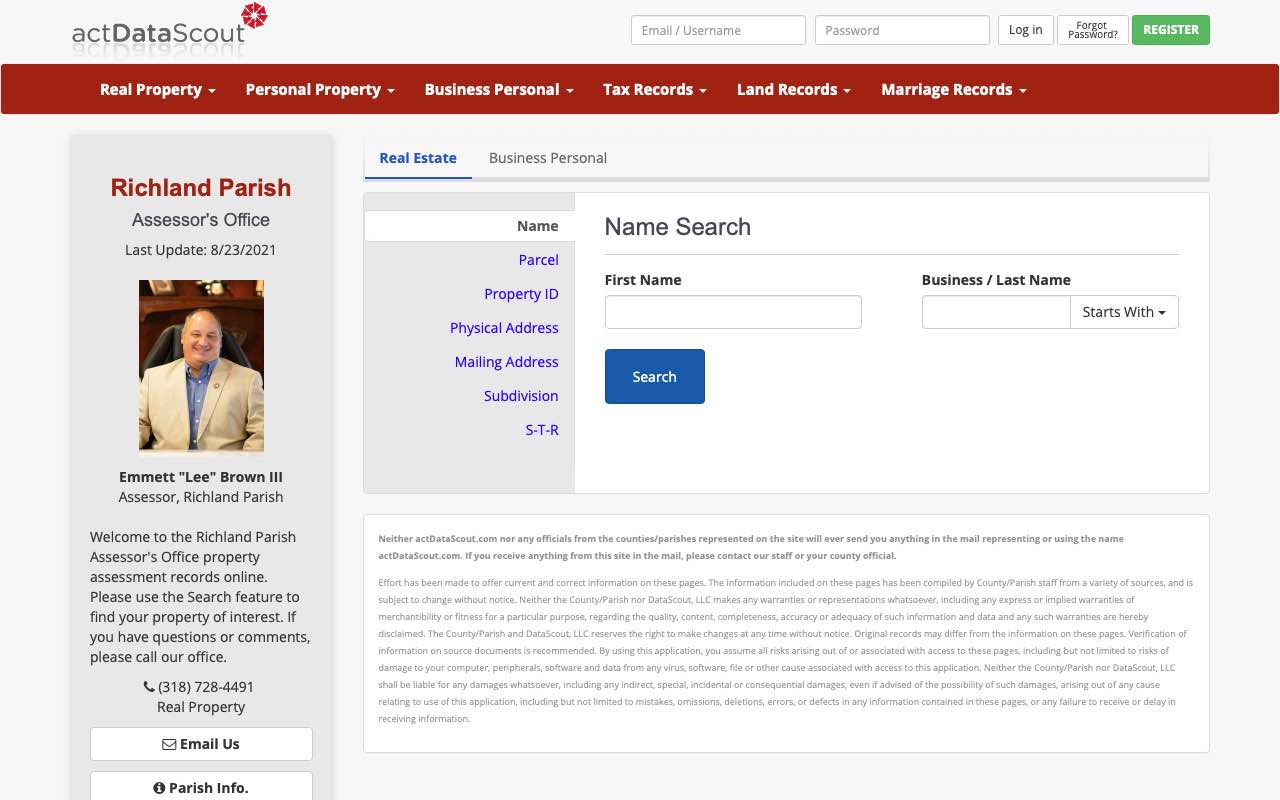

RICHLAND PARISH ASSESSOR

EMMETT "LEE" BROWN III, C.L.A.

WELCOME

I would like to take this opportunity to welcome you to The Richland Parish Assessor's website. I hope you find it beneficial in answering any question you may have. As always if we can be of any assistance to you then please give us a call at (318) 728-4491, and one of my staff members or myself will be more than happy to help you. Our normal office hours are 8:30 A.M. to 4:30 P.M, Monday - Friday.

BIOGRAPHY

Emmett "Lee" Brown is a lifelong resident of Richland Parish and a member of Alto Baptist Church. He and his wife,

Jada Rowland Brown, have two children, Lanya Brown Fussell and Emmett "Lance" Brown IV. Lee enjoys cooking, fishing,

hunting, and most of all spending time with his grand babies.

Lee has made it his mission as assessor to be fair and equitable to everyone and assess all the property in Richland

Parish in that manner. He has always maintained an open-door policy in The Richland Parish Assessor's Office and has

instilled in his staff a deep commitment in serving the residents with a professional and courteous manner as they so

richly deserve.

He is a graduate of NLU with a BBA Major in Finance and Minor in Economics. He is a member of the Board of Trustees to the Louisiana Assessors' Retirement System and a past member of the Board of Directors of the Louisiana Assessors' Association where he has served as treasurer, vice president, and president. Lee has always devoted his time to helping others in his community and abroad. He is a member of the Rayville Kiwanis Club, a former board of director, and has served as president. Lee has always professed any success that he may have had in his life is due to his relationship with his Lord and Savior, a supportive and wonderful wife, family, and a devoted staff.

WE ARE HERE

TO HELP

See our Services page.